Anyone who’s had anything to do with real estate has played the “will they or won’t they” guessing game surrounding the Federal Reserve’s decisions about the federal funds rate.

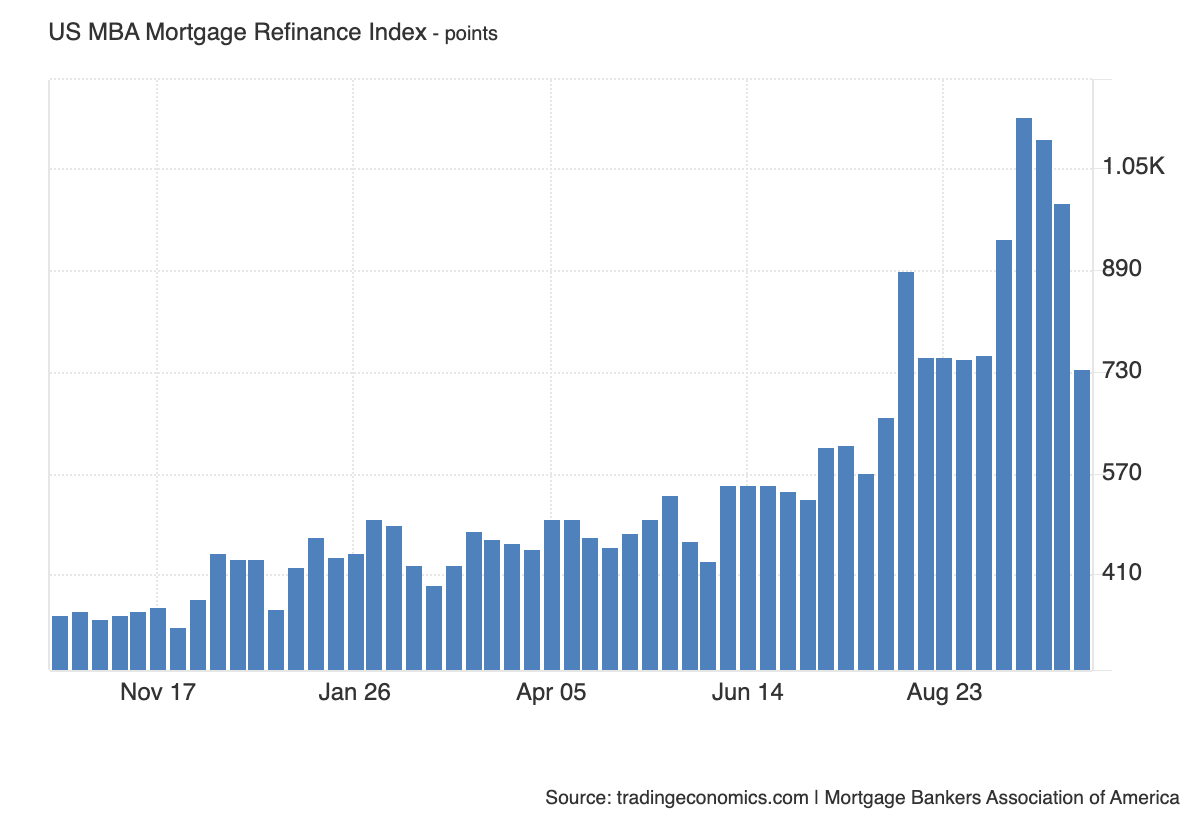

It seems to make sense on its face, since mortgage rates are inextricable from the Fed’s policies. And yet the fact that recent reports show that refinancing activity (which right now accounts for the majority of mortgage applications in the U.S.) dipped 26.8% week over week as of the week ending Oct. 11, despite the much-anticipated rate cuts, should give everyone pause.

What does this unexpected turn of events tell us about the reality of the mortgage market and its possible future trajectories?

Key Rates Are Down, But Lenders Are Cautious

First, a recap: Mortgage rates went down to an average of 6.08% in late September, following the Fed’s half-point cut announcement on Sept. 18. In fact, mortgage rates already were on a downward trajectory since early September, but predictably, the Fed’s announcement delivered an impressive dip, from 6.20% to the just-above-6% many property owners had been hoping for. Refinancing activity surged accordingly, with a 20% spike week over week in late September.

So far, so good. Except, by Oct. 3, mortgage rates had climbed right back up to 6.12%. On Oct. 10, they stood at 6.32%. It was as if the Fed announcement had never even happened.

In any case, it failed to deliver the expected impact. According to Zillow’s metrics, even the relatively small fluctuations in rates translate into 275,000 borrowers missing out on potential refinance savings, or ‘‘a total five-year loss of more than $6 billion combined for those homeowners.’’

The often-quoted rule of thumb in the real estate industry is that if mortgage rates drop one percentage point, it’s worth refinancing. However, in reality, even a rate that’s ‘’one-half to three-quarters of a percentage point lower than your current rate’’ can be well worth it, according to Bankrate. Given that rates were well above 7% as recently as May this year (7.22%, to be exact), even the current rates can be worth taking advantage of for someone who took out a mortgage at above 7%. Obviously, people who took out mortgages more recently will want to wait, as the juice might not be worth the proverbial squeeze just now.

As for the reasons why mortgage rates began climbing again, remember that the key rates set by the Fed are far from the only factor affecting mortgage rates. To some extent, it may even be that the reductions that we saw in September were as much in anticipation of rate cuts as resulting from them.

Freddie Mac makes this point in its U.S. Economic, Housing and Mortgage Market Outlook: “The discourse around the timing and pace of potential future rate cuts will likely drive the near-term path of interest rates rather than the actual policy decision itself.”

It’s the good-old confirmation bias in effect here: Everyone expects mortgage rates to come down because everyone expects a base rate cut; rates do come down, at least in the short term. In the longer term, though, mortgage lenders have to be cautious when setting their rates. They take into account many more factors than just the base rate, including the current state of the job market, the performance of 10-year Treasury yields, inflation rates, and other economic metrics that are more reliable indicators of things to come.

A strong labor market as well as a strong performance from Treasury yields are just two factors spooking lenders. But there are other factors that we tend not to associate with mortgage rate fluctuations, notably macroeconomic factors. The Gaza conflict, for example, is one such factor that has an impact on the domestic economy, but is far less obvious than rate cut announcements.

Sam Khater, Freddie Mac’s chief economist, points to ‘’a mix of escalating geopolitical tensions and a rebound in short-term rates’’ as the reasons behind the upshot in mortgage rates. ‘‘The market’s enthusiasm on market rates was premature,’’ he noted in a statement.

Where Are Mortgage Rates Headed Next?

Investors who were hoping to refinance and increase their monthly cash flow understandably may feel at a loss at this point, wondering: Is it worth waiting for rates to start declining again, or will things get only worse from this point, in which case now is the time to act?

The good news is that most mortgage experts and economists agree that the overall mortgage rate trajectory for the rest of this year and going into 2025 is still downward. The difference in opinion is only in terms of how much of a decline can be expected.

Freddie Mac’s view: “While there is likely to be some volatility around any policy statements,” mortgage rates will continue to decline, “though remaining above 6% by year-end.”

Keith Gumbinger, vice president at mortgage information website HSH.com, concurred with these predictions, telling Forbes Advisor, “Things are changing fast—but for now, I’d say that 6% to 6.4% is a more likely range for the next while.”

Basically, rates that hover just above the 6% mark are the best-case scenario. The predictions of rates in the 5% to 6% range that some experts made earlier in the year do seem unlikely at this point. Potentially, this is still good news for anyone whose current mortgage is in the near-7% range, because they may be able to lock in rates of just above 6% later this year or in 2025.

If rates continue to hover around the 6.3% to 6.4% mark, refinancing may become unwise for many investors. It’s always crucial to remember that refinancing comes with costs—essentially, you’re doing the whole mortgage application all over again, including appraisals and closing fees.

“Remember that just because you can get a lower rate doesn’t mean you should immediately refinance,” Matt Vernon, head of retail lending at Bank of America, told Forbes Advisor. “You may be paying a lower monthly mortgage, but you may have to also extend the life of your loan, and refinancing could cost you more in interest.”

This advice is for homeowners, but it holds for investors considering rate-and-term refinances. Any investors thinking of selling within the next five years probably shouldn’t bother with a refinance. But if you’re planning on keeping the property for the next 15 to 20 years, that’s a different story.

You’ll also need to think differently if you’re considering a cash-out refinance. These almost invariably will come with a higher rate, but the lump sum of cash can be worth it for investors who want to pay off debts accrued from property maintenance and/or to purchase another investment property. Accurately calculating the return on that new investment is more important than interest rates in this case.

Final Thoughts

Mortgage rate fluctuations happen for a variety of reasons, with the Fed key rate announcements playing a more limited role than it can seem from the headlines. Investors who were hoping to refinance late this year or next may still be in luck since most economists are confident in the overall downward trajectory for mortgage rates. Just don’t expect miracles: A rate of just above 6% is the best-case scenario for the next few months.

Ready to succeed in real estate investing? Create a free BiggerPockets account to learn about investment strategies; ask questions and get answers from our community of +2 million members; connect with investor-friendly agents; and so much more.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.